An Economy Built on Consumption: Why the U.S. Is Standing on Shaky Ground

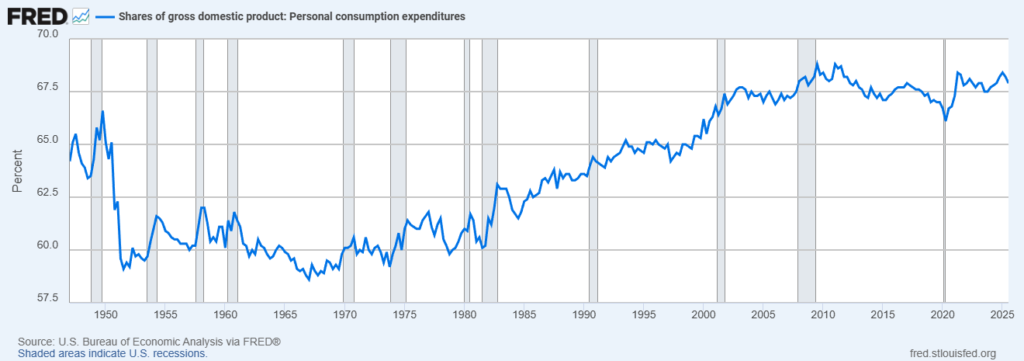

Consumer spending accounts for roughly two-thirds of U.S. economic output. No other major economy in modern history has sustained a consumption share this large for so long.

An economy dominated by consumption is not self-funding. It survives only as long as credit expands and asset prices rise.

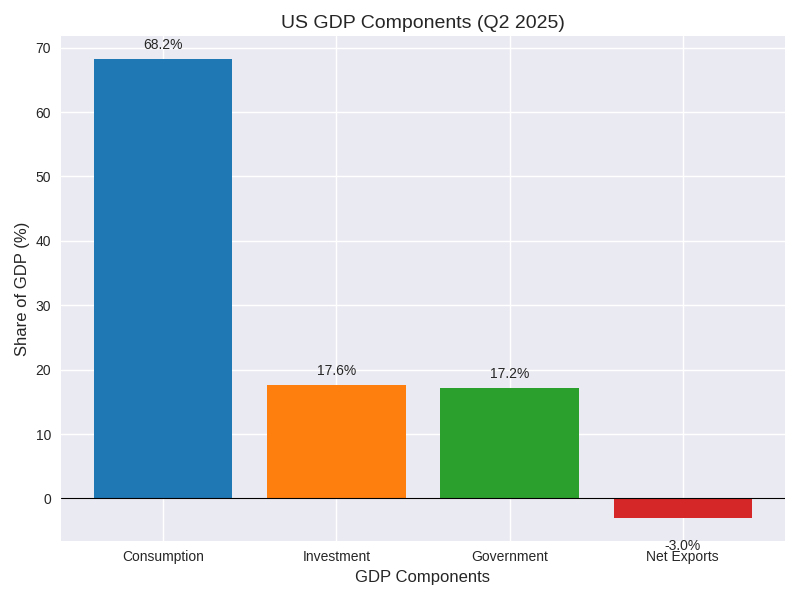

Consumer spending has remained near two-thirds of U.S. GDP for more than four decades—an unprecedented and historically unstable economic structure. The chart directly below details the current makeup of GDP, with consumption dwarfing all other categories.

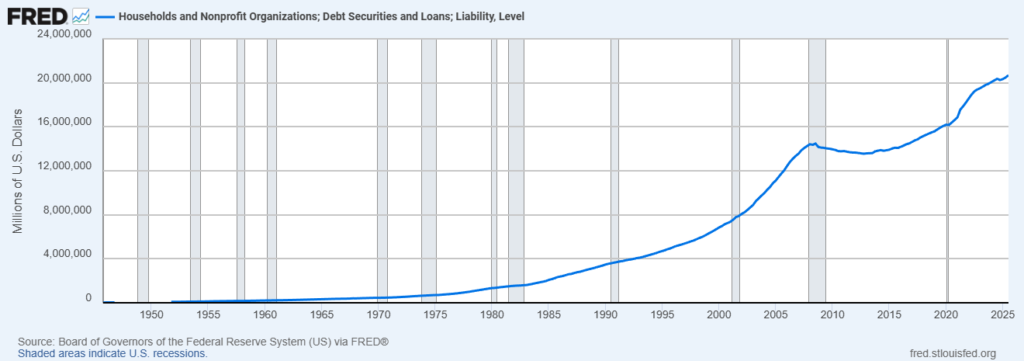

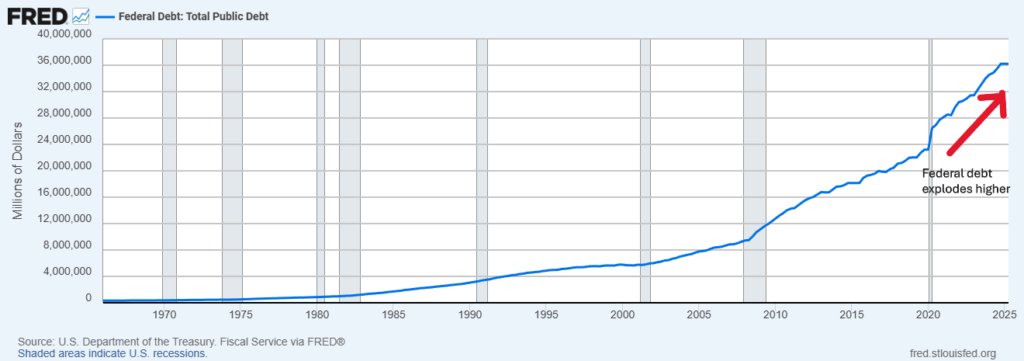

As I explained in my post on Federal Reserve Intervention, debt creation, which has funded investment and spending, has been the key driver of this phenomenon we see now. It is clear from the charts above that spending has been mainly facilitated by borrowing.

The debt–consumption feedback loop

This is the mechanism that has driven U.S. growth since the early 1980s

- Easy money lowers borrowing costs

- Borrowing fuels consumption

- Consumption inflates asset prices

- Rising asset prices justify more borrowing

- The cycle feeds on itself

This is not sustainable long-term, but it has endured longer than would normally be expected. This is chiefly due to a few specific reasons that apply to the United States economy.

- Reserve currency privilege

- Ability to run perpetual trade deficits

- Global recycling of dollar surpluses

- Financial innovation masking risk

What appears to be economic strength is, in reality, a delayed reckoning made possible by unique financial privileges—not by sustainable fundamentals.

At this point, a reasonable question arises: why can’t this cycle continue indefinitely? Many have postulated that as long as the U.S. can borrow money in its own currency (Modern Monetary Theory), this process can continue indefinitely. Yet, as you will see, this logic is entirely flawed.

Consumption does not generate future income

It must be funded by:

- Rising wages (not happening)

- Rising debt (happening)

- Rising asset prices (the key driver)

As I demonstrated in the post on Federal Reserve Intervention, bubbles have formed in many asset classes, and some appear to be clearly unsustainable. The bursting of some or many of those bubbles is, I believe, very near. The primary reason for this is that the cycle of debt creation funding this expansion is running into the reality of debt saturation. Debt has grown too large and is increasingly unmanageable based on current income, in all sectors of the economy.

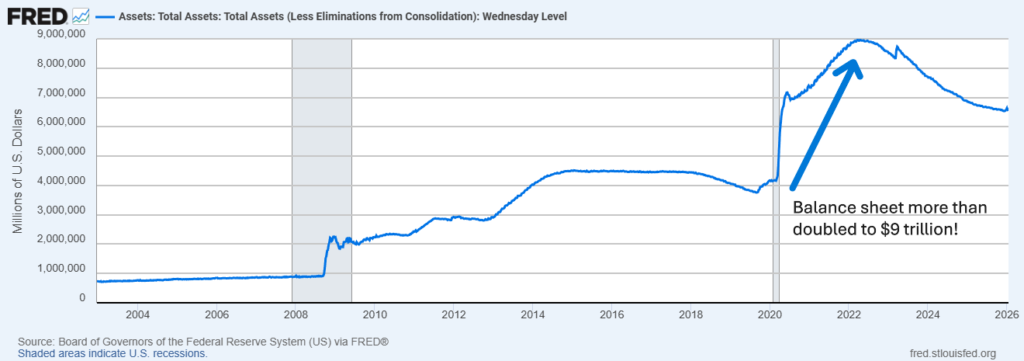

Why do you think economists and politicians panic when the economy shows signs of slowing? Precisely because if the consumer stops spending at current levels, the economy will tank. This would expose the fragility of this current system. So, at times like the pandemic, for example, the Fed and the government injected massive amounts of liquidity to make sure the consumer kept spending. This rescued the system temporarily, but at an enormous cost. Trillions of dollars were added to our national debt, and the Fed also increased its balance sheet by trillions. Please observe what was required to keep this system functioning.

Federal Reserve Balance Sheet

Explosive expansion during every major economic stress event

To compound the problems for the Fed, to try to accomplish its mandate of stable prices and achieve its stated goal of 2% inflation, is that when it now begins to tighten monetary policy to any extent, there is an immediate backlash by consumers. Obviously, higher rates and tighter money squeeze those who are up to their ears in debt. Politicians complain, businesses grumble, markets retreat, and things get gloomy. The Fed is then forced to relax its tightening posture, which has, so far, allowed for another burst higher in many asset classes and has maintained consumer spending. But all this comes with a huge cost: entrenched higher inflation.

While official inflation measures appear relatively well-behaved, lived inflation tells a very different story. That’s why consumers are so stressed, as they see their cost of living much more elevated than, for example, what the Consumer Price Index (CPI) reflects. This is made even more painful by the effect of higher costs and higher interest rates on massive debt. If you look again at the chart of total federal debt, which now stands at a breathtaking $38 trillion, and personal debt, which stands at more than $20 trillion, you understand the magnitude of this problem. The Federal debt alone amounts to over $100,000 for every person in this country! That is truly mind-boggling and does not present many options for a solution.

If this debt-dependent system begins to unwind, here is a likely progression:

What breaks first when consumption falters

- Credit tightens

- Asset prices wobble

- Household balance sheets weaken

- Consumption falls

- Corporate revenues contract

- Government deficits explode

Why this is not a normal recession risk

- There is no historical playbook for unwinding a system this skewed

- Policy responses are increasingly constrained

- Each prior rescue increased dependence on consumption and leverage

Really, in the long run, there are only two solutions to this debt problem, neither of which is appealing. First, the Fed could print money like crazy, eroding the dollar, and essentially inflating the debt out of meaningful existence. This, of course, would be very painful for U.S. consumers, as their purchasing power would plummet, inflation would surge, etc. The dollar would likely lose its reserve currency status, which would exacerbate the fallout even further.

The second option, as far as government obligations go, would be a controlled default of some sort. This is highly unlikely, almost impossible to imagine for this country, so I would not bet on that. But, aside from those two options there is really no alternative. Except perhaps one: if the bubbles that are present burst, and a lot of false wealth is destroyed, debt would be eliminated by consumer debt repudiation. Eventually, the economy would reset, valuations would return to normal markers as far as levels go, perhaps consumers would realize the folly of massive debt, and something other than consumer spending would emerge as the main driver of the economy. Maybe like production and exports? That used to be the engine that made the U.S. the most powerful economy in history. It could emerge again, but it will take pain to get there.

I want you to understand that, although much of this information could be perceived as negative, I do not view it that way. In my career, I strived to always write the truth about the environment and plan strategies accordingly. My subscribers and clients benefited from the observations they received about the economy and were able to use my model’s guidance to position themselves in such a way as to avoid the trouble that was about to unfold and allocate their portfolios to profit from the inevitable outcomes.

In 1987, the model warned of a stock market collapse. We moved out of stocks. We bought Put options on the S&P 500 index. Our gain was dramatic during the collapse. In 2000, before the tech bubble burst and stocks collapsed, we exited the stock market completely. We bought US T-Bonds. We made substantial profits while most were losing big in stocks. Before the Great Recession of 2008, we bought vehicles (inverse index options and inverse index ETFs) that profited from the collapse.

There are so many ways, in modern market mechanics, to position yourself to profit from unfolding trends, in addition to protecting yourself from inevitable declines or collapses. We have used and will continue to use a variety of approaches, such as Exchange Traded Funds (ETFs), options, inverse derivatives, and leveraged long and short investment vehicles, as well as hedging strategies to protect profits without having to sell, if necessary.

This information, which I believe will prove to be accurate, can give you the insight to realize there is much more to successful investing than simply to ‘buy and hold’ and grit your teeth when the inevitable resets occur. You don’t have to be held hostage to outdated ideas that simply don’t hold up under current conditions. I always used to tell my clients and subscribers: “While it may be true that asset prices will eventually recover after a sharp decline, that doesn’t do you much good in the present if you want to retire, or start a business, or send your kids to college, etc.” It is far better to avoid pain, invest in what will be profitable now, and prepare to adjust for the future accordingly.

Although the most dramatic and fastest gains the model has produced have been in down moves in the stock market (mainly because markets always fall faster than they rise), most of the time the model has signaled to be invested in the market. But the chief difference is that once a crash signal emerges, it is far better to be out of the market and into something else, even if that means T-bills. We are quickly approaching a signal that will forecast dramatic changes in the status quo.

I will keep you posted.

Disclaimer: The information provided is for educational purposes only and should not be construed as investment advice. Financial markets involve risk, and past performance is not indicative of future results. Readers should consult a qualified financial professional before making any investment decisions.